Automating Portfolio Weighting

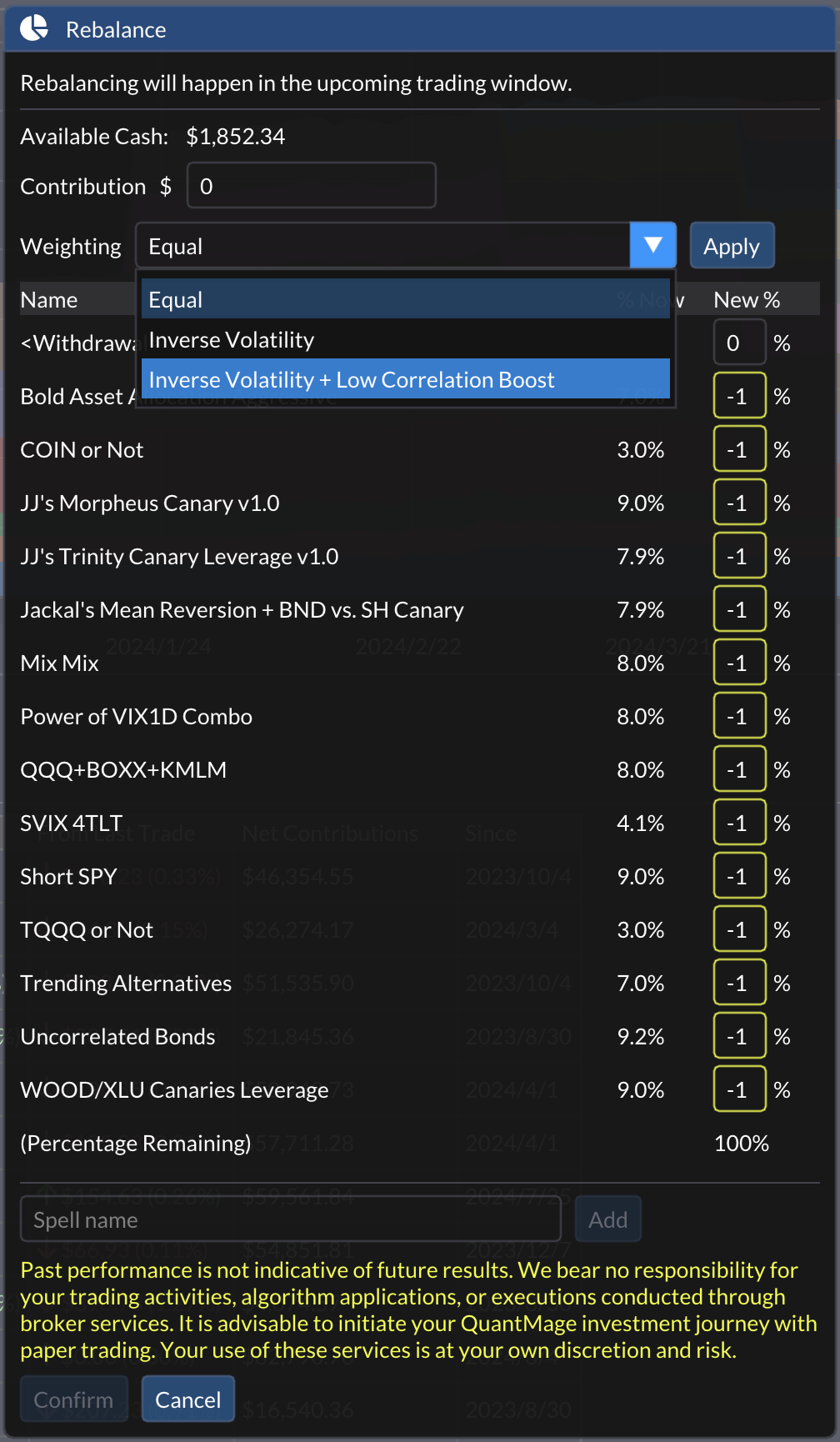

Managing portfolio allocations can be a hassle, but QuantMage makes it a breeze. With our automation tools, you can skip the tedious calculations and back-and-forth between Cast Spells and multiple Grimoire tabs during rebalancing. We offer three handy options: Equal weighting, Inverse Volatility, and Inverse Volatility + Low Correlation Boost.

Weighting Options

Section titled “Weighting Options”- Equal Weighting: This straightforward method assigns the same weight to each spell.

- Inverse Volatility: This option uses each spell’s historical volatility to weight them by their inverses. Lower volatility spells get higher weights.

- Inverse Volatility + Low Correlation Boost: This advanced method goes a step further by considering correlations between spells. Spells with lower overall correlations receive a boost. It calculates each spell’s correlations with others, adds one to ensure positivity, and sums them up. The inverse of this sum is then multiplied with the inverse volatility to determine the final weight.

Keep in mind that using all available history might favor spells with short histories due to potentially lower volatilities and correlations.

Custom Weight Adjustments

Section titled “Custom Weight Adjustments”QuantMage also offers flexibility. If you have specific weights in mind, you can fix those and let the system calculate the rest. Simply assign non-negative values to the spells you want to fix, and our system will handle the rest. In the screenshot above, the yellow-highlighted entries show where the weighting will be applied.

A Word of Caution

Section titled “A Word of Caution”No weighting tool is perfect for everyone, so consider these tools as a starting point. Use your discretion to see if the computed weights align with your portfolio strategy and adjust accordingly.

QuantMage is here to help you make informed decisions and streamline your investment process. Let’s make your investment journey smoother and more efficient!