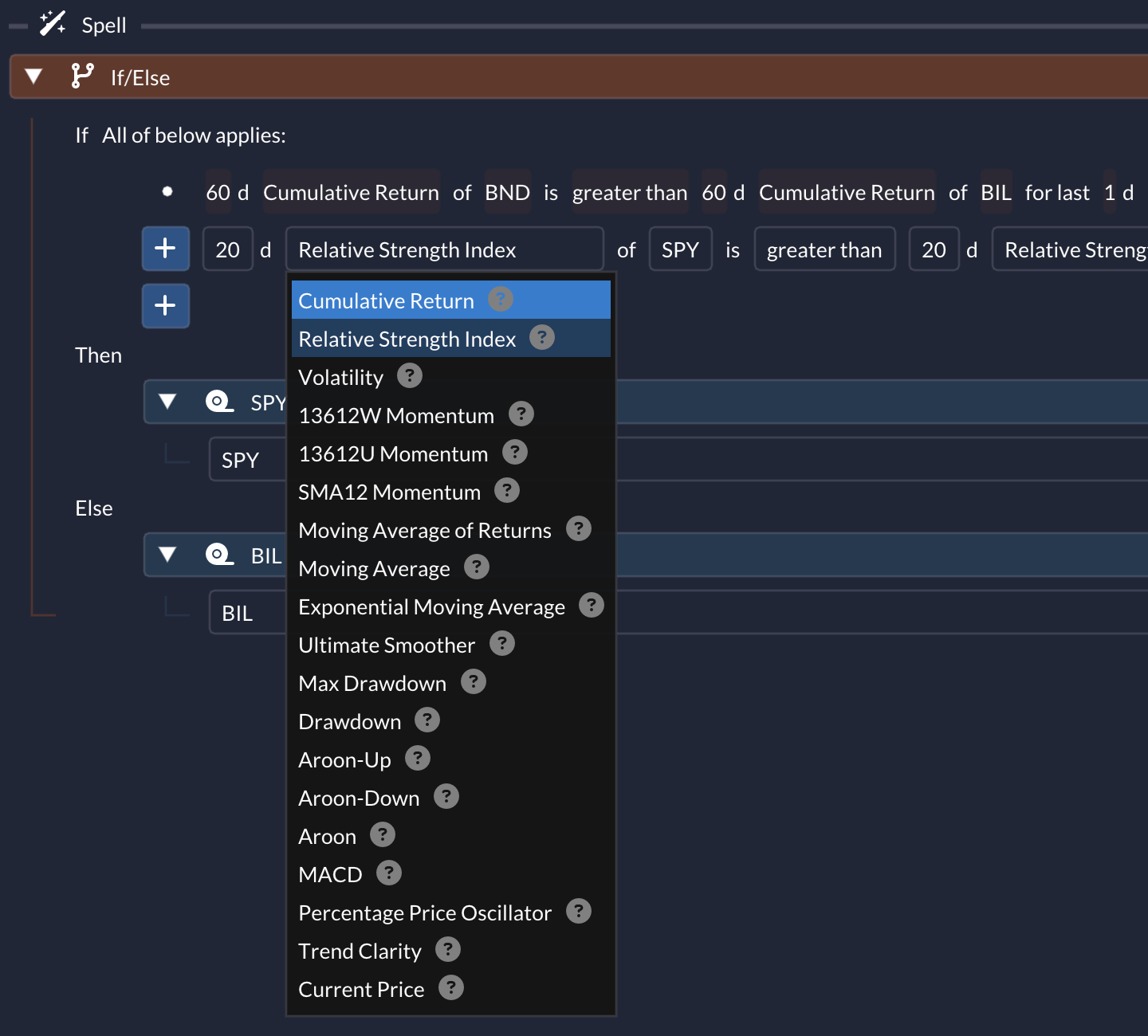

Indicators

Welcome to the heart of QuantMage’s magic: our technical indicators. These are the essential elements that breathe life into your spells. They play pivotal roles in incantations like If/Else, Switch, Enter/Exit, Mixed, and Filtered. Let’s unravel the mysteries behind these indicators and discover how they can be your guiding stars in the vast universe of trading.

Cumulative Return

Section titled “Cumulative Return”Think of this as a snapshot of how an asset has performed over a specific period. It’s the percentage return during that time. For instance, the 1-day cumulative return of SPY is calculated as (Today's Price of SPY / Yesterday's Price of SPY - 1) x 100. Here, and in other indicators, we typically use daily closing prices.

Relative Strength Index

Section titled “Relative Strength Index”The RSI is like a compass for traders, guiding them through the turbulent seas of price movements. It measures the momentum of price changes, helping traders navigate potential overbought or oversold territories. Here’s a quick breakdown:

Basics:

Section titled “Basics:”- Range: The RSI dances between 0 and 100. Traditionally, values above 70 signal overbought conditions, while those below 30 hint at oversold territories.

- Formula: The magic formula for RSI is:

Here,RSI = 100 - 100 / (1 + RS)

RS(Relative Strength) is the average ofndays’ up closes divided by the average ofndays’ down closes. The twist? The average is an exponential moving average.

Interpretation:

Section titled “Interpretation:”- Overbought/Oversold: As mentioned, levels above 70 might indicate a potential price pullback, while levels below 30 suggest a potential price bounce.

- Divergence: If an asset’s price hits a new high or low, but the RSI doesn’t follow suit, it’s a divergence. This can be a sign of a potential price reversal.

Remember, while RSI is a powerful tool, it’s essential to use it alongside other indicators and analyses.

Volatility

Section titled “Volatility”Imagine a roller coaster. The more twists and turns it has, the more “volatile” the ride is. Similarly, in trading, volatility measures the price fluctuations of an asset. It’s the standard deviation of returns, giving you a sense of the risk associated with an asset. In QuantMage, we also use its inverse for weighting in Weighted and Filtered.

13612W Momentum

Section titled “13612W Momentum”This indicator is like a crystal ball, giving you a glimpse of an asset’s momentum over a year by considering 1-month, 3-month, 6-month, and 12-month returns. It weighs more recent returns higher to provide a quicker signal:

(12 x (P0 / P1 - 1) + 4 x (P0 / P3 - 1) + 2 x (P0 / P6 - 1) + (P0 / P12 - 1)) / 19Where Pn is the price n months ago. A value greater than zero indicates a bullish momentum.

13612U Momentum

Section titled “13612U Momentum”A sibling to 13612W, this indicator uses an unweighted average, producing a slower signal:

((P0 / P1 - 1) + (P0 / P3 - 1) + (P0 / P6 - 1) + (P0 / P12 - 1)) / 4Where Pn is the price n months ago. Again, a value greater than zero hints at a bullish momentum.

SMA12 Momentum

Section titled “SMA12 Momentum”This provides another relative momentum signal over a year. And it’s the most patient of the three, offering the slowest signal:

13 x P0 / (P0 + P1 + ... + P12) - 1Where Pn is the price n months ago.

Moving Average of Returns

Section titled “Moving Average of Returns”This is the arithmetic mean of daily returns over a specific period.

Moving Average

Section titled “Moving Average”This is the simple average of an asset’s daily close prices over a specific period.

Exponential Moving Average

Section titled “Exponential Moving Average”A twist on the moving average, this one gives more weight to recent prices, making it more responsive to current market conditions. The weights for n-day EMA are applied as below:

W = 2 / (n + 1)EMA = previous EMA x (1 - W) + current Price x WUltimate Smoother

Section titled “Ultimate Smoother”While the EMA is a simple first-order filter that smooths data by giving more weight to recent prices, the Ultimate Smoother, developed by John Ehlers, uses a more sophisticated method that subtracts the response of a High Pass filter from the input data to minimize lag, resulting in more timely signals with a slight trade-off in smoothness.

Max Drawdown

Section titled “Max Drawdown”It measures the most significant drop from a peak to a trough over a set period, helping you gauge the risk of an asset or strategy.

Drawdown

Section titled “Drawdown”It measures a percentage drop from the all-time peak to the current price. You can combine this with a subspell to accomplish a trailing stop loss.

Aroon-Up / Aroon-Down / Aroon

Section titled “Aroon-Up / Aroon-Down / Aroon”Derived from the Sanskrit word “Aruna,” which means “dawn’s early light,” the Aroon indicator is like the first rays of the morning sun, illuminating the path of price trends. Crafted by Tushar Chande in 1995, it’s a beacon for traders to identify the strength and direction of trends.

Components:

Section titled “Components:”The Aroon indicator consists of two separate lines:

- Aroon-Up: Measures the strength of the uptrend.

- Aroon-Down: Measures the strength of the downtrend.

Calculation:

Section titled “Calculation:”The brilliance of Aroon lies in its simplicity. It’s based on the number of periods since the highest high and the lowest low, respectively, over a predefined period (commonly 25 days).

Aroon-Up = ((n - Days Since n-day High) / n) x 100Aroon-Down = ((n - Days Since n-day Low) / n) x 100Interpretation:

Section titled “Interpretation:”Aroon-Up/-Down are percentage indicators that respectively measure how recent the n-day high or low has been. On top of the two complementary indicators, QuantMage also provides the Aroon Oscillator, which is calculated by subtracting the Aroon-Down from the Aroon-Up. The oscillator oscillates between -100 and 100, with zero as the centerline. Positive values indicate an upward trend, while negative values suggest a downward trend. These are the only indicators here that use daily high / low prices instead of daily close prices.

Remember, while Aroon is a guiding star, always sail with a constellation of tools for a successful trading voyage.

The MACD (Moving Average Convergence Divergence) histogram is a visual storyteller, narrating the tale of price momentum and direction.

Components:

Section titled “Components:”- MACD Line: Calculated by subtracting a 26-day Exponential Moving Average (EMA) from a 12-day EMA.

- Signal Line: A 9-day EMA of the MACD line.

- MACD Histogram: Represents the difference between the MACD line and the signal line.

Interpretation:

Section titled “Interpretation:”- Above Zero: When the histogram is above the zero line, it indicates that the MACD line is above the signal line, which can be a bullish sign.

- Below Zero: When the histogram is below the zero line, it suggests that the MACD line is below the signal line, which can be a bearish sign.

As with all technical indicators, the MACD histogram should be used in conjunction with other tools and methods to make informed trading decisions.

Percentage Price Oscillator

Section titled “Percentage Price Oscillator”The Percentage Price Oscillator (PPO) is a momentum-based technical analysis indicator that expresses the difference between two moving averages as a percentage. While it shares a kinship with the MACD, its unique trait is its independence from the price level, making comparisons across securities as smooth as a well-tuned scale.

Components:

Section titled “Components:”- PPO Line: Represents the difference between a 12-day EMA and a 26-day EMA, expressed as a percentage:

(12-day EMA - 26-day EMA) / 26-day EMA x 100

- Signal Line: A moving average (typically a 9-day EMA) of the PPO line.

- PPO Histogram: Represents the difference between the PPO line and the signal line.

Interpretation:

Section titled “Interpretation:”The indicator outputs histogram values. Positive values are like a scale tilting upwards, indicating bullish momentum. In contrast, negative values suggest a downward tilt, signaling bearish momentum.

The PPO histogram provides traders with a normalized measure of the difference between two moving averages, allowing for easier comparisons across different securities or timeframes. Always ensure it’s complemented with other instruments in your analytical toolkit.

Trend Clarity

Section titled “Trend Clarity”Trend Clarity is a metric that tells you how pronounced (or clear) a trend is. It works by measuring the R-squared value (or coefficient of determination) of a simple linear regression of price data.

Interpretation:

Section titled “Interpretation:”- 100% Clarity means the price data forms a perfect line, indicating a very clear trend.

- The farther each price point deviates from the approximate (i.e. regressed) line, the lower the Trend Clarity score gets.

- 0% suggests that the line is no better in approximating the data than simply using the average price for the period.

This metric helps you gauge the strength of a trend and figure out whether it’s likely to continue or revert. Want more details? Check out this article.

Current Price

Section titled “Current Price”The heartbeat of an asset. It’s often compared to moving averages to discern trends.

Embark on your QuantMage journey with these indicators as your guiding stars. Craft spells, weave strategies, and let the magic of trading unfold! 🌌🔮

Further Resources

Section titled “Further Resources”For those eager to delve deeper into the world of technical indicators, here are some resources: