What The Heck Is YC/TO?

Ever spotted that (YC/TO) tag on Grimoire’s backtest chart and wondered what’s up with that? Let’s break it down. This nifty plot shows you a simulation where we evaluate the logic using yesterday’s closing prices and then, plot twist, trade based on today’s opening prices. So, there’s a tiny pause between when we evaluate and when we actually trade. But wait, if our automated trading tries to evaluate and trade just before the market closes each day, why even show this?

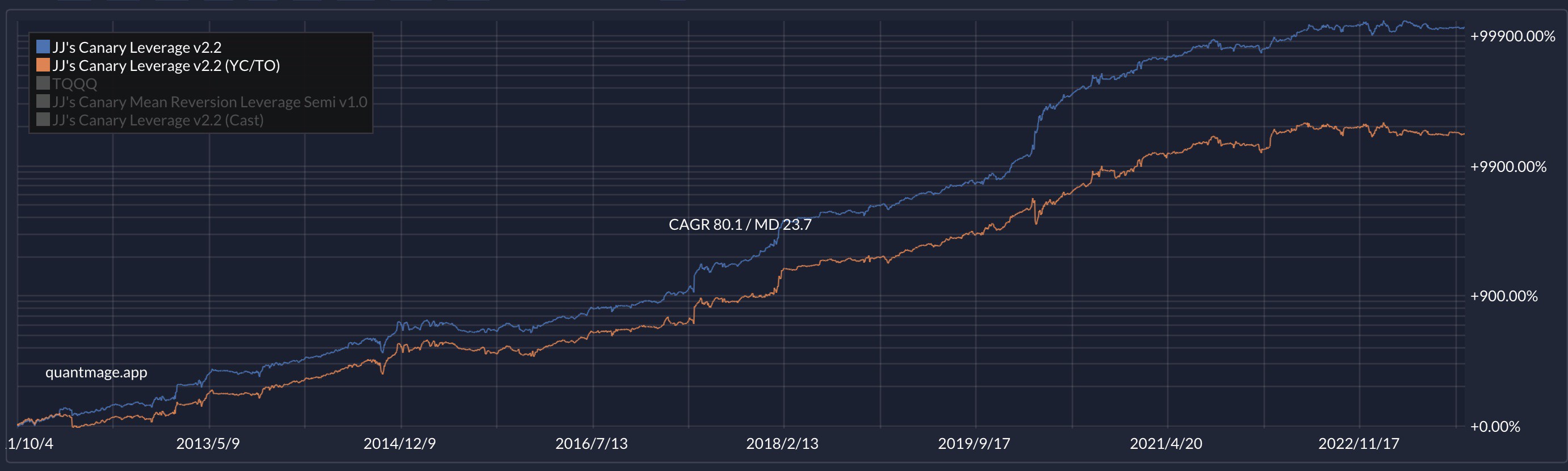

Feast your eyes on this:

Mind-blowing, right? Both plots come from the same strategy. The only difference? One’s fashionably late by about half-a-day. If you switch to the log-scale view, you’ll see they groove together, but occasionally one misses the beat:

Mind-blowing, right? Both plots come from the same strategy. The only difference? One’s fashionably late by about half-a-day. If you switch to the log-scale view, you’ll see they groove together, but occasionally one misses the beat:

What’s the takeaway? It’s a reality check on how timing can play tricks on your spell logic. And it is why you need to take any backtesting result with a grain of salt. A backtest shows just one possibility (what actually happened) among the vast possibility space of a stochastic process (what could have happened). Future is everything we don’t know. So, as you embark on your investment adventure, remember to stay grounded and keep it real. Happy investing!