Using Price Ratios as Indicator Symbols

A myriad of technical indicators—combined with raw price data—can already yield valuable insights. However, if you want to refine your search for alpha, consider incorporating price ratios as an additional dimension. By taking one symbol’s price and dividing it by another, you can highlight relative performance, detect regime shifts, and unlock a deeper understanding of the market’s caprices.

Why Use Price Ratios?

Section titled “Why Use Price Ratios?”Price ratios allow you to compare two assets directly: for example, how does a cyclical commodity perform relative to a defensive one? Or how does an internet ETF compare against the utility sector?

- Identify Market Regimes: When the ratio is rising, your chosen “numerator” may be outperforming the “denominator” and vice versa.

- Spot Momentum Shifts: Rapid changes in the ratio often imply shifts in investor preference or risk sentiment.

- Enhance Indicator Comparisons: Indicators applied to a ratio can sometimes reveal leading signals that might be obscured when applied to prices alone.

How to Create a Ratio

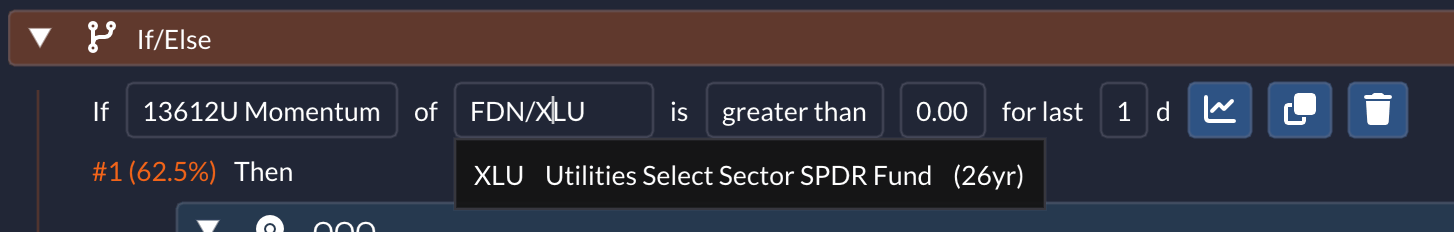

Section titled “How to Create a Ratio”Creating a price ratio in QuantMage is straightforward:

- Type a Symbol: Enter your primary symbol as usual (e.g., FDN).

- Use the “/” Key: Immediately after the primary symbol, type “/” (slash).

- Add the Second Symbol: Enter your comparative symbol (e.g., XLU).

- Apply Your Indicator: Pick the indicator you want to apply to the ratio—this helps you detect trends or momentum in the ratio itself.

Example:

FDN/XLU with the 13612U Momentum indicator to see how the internet industry’s momentum stacks up against the utility sector.

Example:

FDN/XLU with the 13612U Momentum indicator to see how the internet industry’s momentum stacks up against the utility sector.

Takeaway

Section titled “Takeaway”Price ratios offer a powerful method for discerning relative strength and understanding market trends. By experimenting with ratios in QuantMage—whether you’re comparing entire ETFs or individual stocks—you can uncover fresh insights and construct more refined trading strategies.

Keep pushing your creativity and harness the power of price ratios to gain the upper hand in your quest for alpha!